We all are aware that our world is a client driven world. We need to get workarounds for most of the requirements we gather. We came across one such requirement to configure work logs for Invoice application. So, we added relationships from INVOICE object to WORKLOG object as recordkey=:invoicenum and class='INVOICE'. We included the work log tab in our application xml. When we decompiled the WORKLOG.class in psdi.app.ticket folder in MAXIMO 7.6, we could see it includes PO and PR with earlier TICKET and WORKORDER class records only. So. while you want to add a record to WORKLOG from Invoice application, system is unable to decipher what is the parent class, what to set in recordkey field, etc.

We explored two approaches to get a work around to the above stated problem. One is to insert records into APPFIELDDEFAULTS table using below sql insert scripts

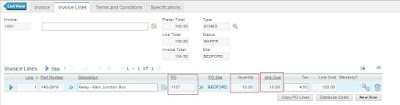

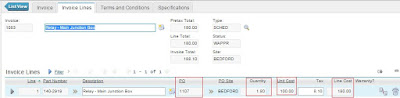

Next approach which is also very effective is using automation script. We created an object launch point on WORKLOG object with event as Initialization and wrote our source code as attached in the images below:

So far so good. We had another requirement to add similar tab to Item Master application. We had configured every thing accordingly but on click of New Row button in the Work Logs tab, we encountered the below error:

We found out that ITEM object is at ITEMSET level and does not have ORGID attribute, so we were thrown this particular error from the system. So, we rolled back all configuration changes we had done to add the Work Logs tab in Item Master application as any other application with Logs tab. We could not find a solution. As a work around, we created a custom object which had all the attributes as WORKLOG object, created a new relationship from ITEM object to this custom object and managed to add records to this new custom object. If someone had encountered such a scenario and were able to find a better solution, please feel free to share your thoughts.

References: